What do the U.S. dollar, South African rand, the British pound, Indian rupee, Japanese yen and Chinese yuan have in common?

They are among the currencies being used in Zimbabwe as a solution to the country's problems with hyperinflation.

Since 2009, Zimbabwe has used other currencies in lieu of its own, which it abandoned after hyperinflation of more than 5,000 percent made it essentially worthless.

This system of using multiple currencies has led to a deflation rate of -2.3%, according to Zimbabwe's bank governor.

"We changed to a multiple currency system to stabilize, and inflation went down to 0% and it was magic," said the Zimbabwe Reserve Bank Governor, John Mangudya.

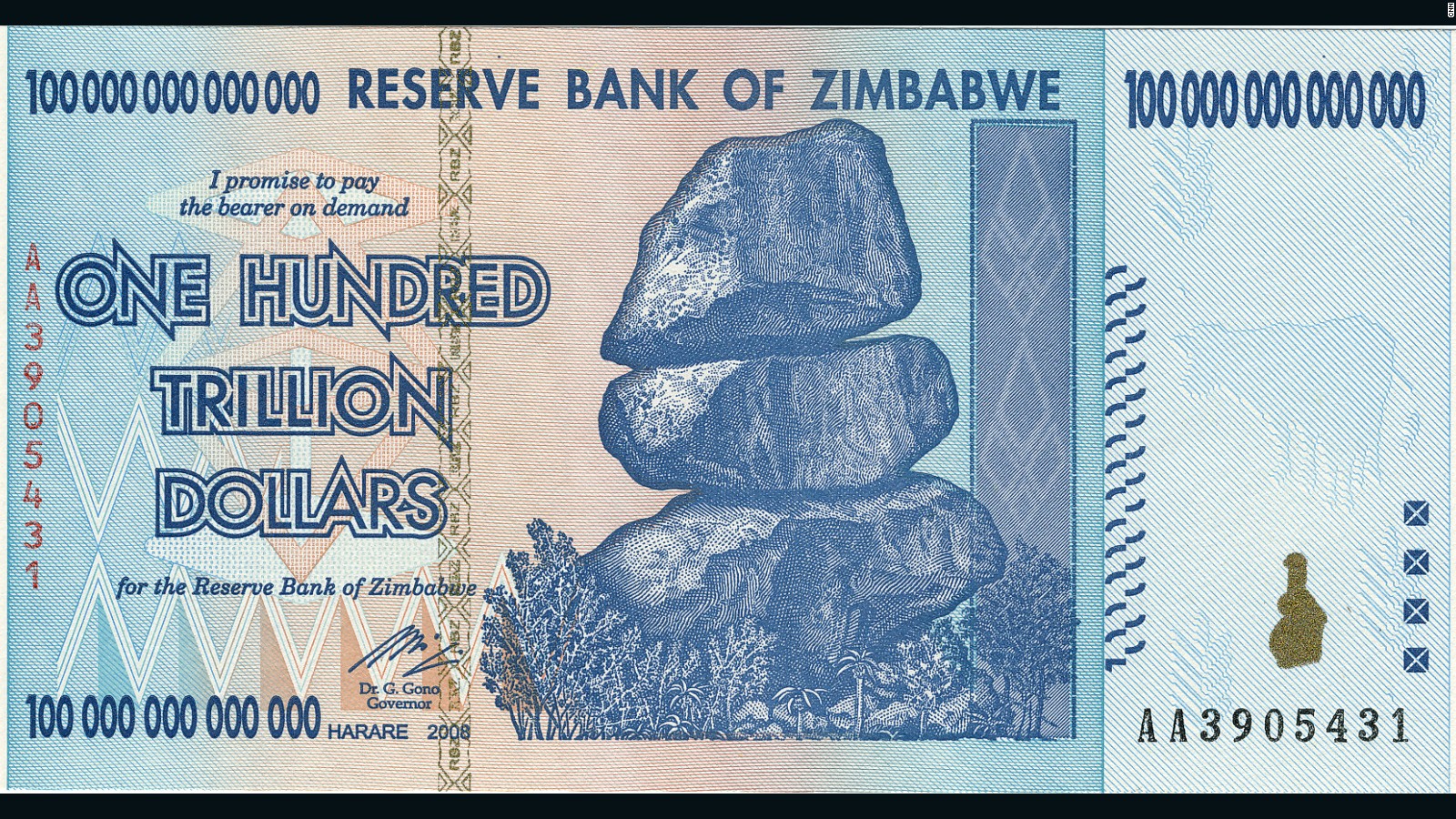

Z$100,000,000,000,000

Zimbabwe used to have a Z$100,000,000,000,000 note - one trillion Zimbabwean dollars.

The note, along with previous hyper-inflated denominations including Z$10,000,000,000,000 (ten trillion) and Z$1,000,000,000,000 (one trillion), could be exchanged for U.S. dollars until the end of April 2016, but it was worth only about $0.40. It is fetching significant higher prices as a novelty item on websites such as eBay.

When inflation hit 230,000,000 percent in 2009 , the country's reserve bank -- infamous for its inability to contain sky-high hyperinflation -- declared the U.S. dollar as its official currency.

From excessively high inflation to -2.3% deflation, Mangudya remembers the tough years vividly. "It was so traumatizing," he admitted. "We didn't have the tools to fight the monster that the economy was facing at the time."

The country had to keep printing money. Prices would change by the minute, causing stress revolving around the fluctuations, one of the devastating effects of hyperinflation.

"It was terrible. You'd have to pay for your coffee before you drank it because if you waited the cost would rise within minutes," said businessman Shingi Minyeza, chairman of Vinal Investments.

Dollar is king

The U.S. dollar is the preferred currency in Zimbabwe at present, but others are welcome.

"We are saying that since you can import/export goods from South Africa you can use the rand. If you are importing from China you can use the yuan. The U.S. dollar is our reserve currency," explained Mangudya.

Zimbabwe seems years away from reintroducing its own currency. In the meantime, it has coins called bonds. For each coin in circulation there's an equivalent U.S. dollar coin held in reserves.

There are over $13 million worth of these coins in the country, CNN was told, but recently banks have started printing "bond notes" representing U.S. dollar values up to $20, due to a cash shortage.

Seems the more things change, the more that going back to the basics is the only option.

To follow us on twitter click @iReporterng

To Like our facebook fan page click iReporter on Facebook

Join Us on BBM Channel Add Pin or click: C00224051

Report News as its UNFOLDS via: ireporterng@gmail.com

No comments:

Post a Comment

Subscribe to our publication. Do not miss out on any information.

Join us on Facebook:

https://facebook.com/ireporterinternational

Follow us on Twitter:

https://twitter.com/ireporterng

Note: Only a member of this blog may post a comment.